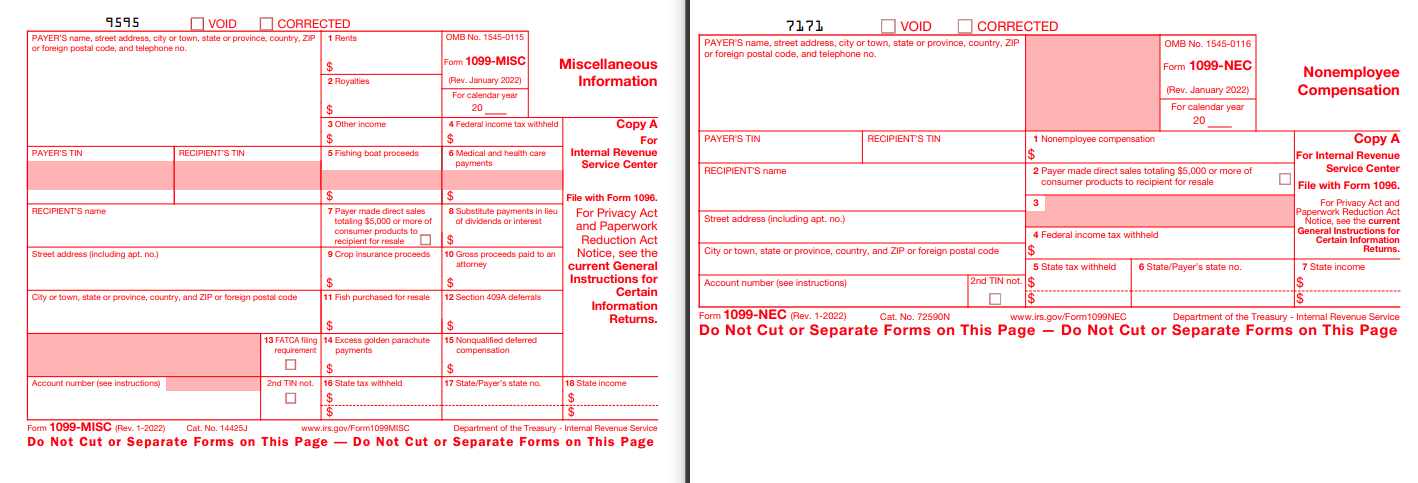

1099 Forms

1099-NEC and 1099-MISC

File form 1099-NEC, for each vendor* in the course of your business to who you have paid the following during the year:

- At least $600 in services performed by a vendor who is not your employee(including parts and materials), or payments to an attorney

- These are typically due out by the end of January to IRS and vendor* (See irs.gov to find the exact date each year)

File form 1099-MISC, for each vendor* in the course of your business to who you have paid the following during the year:

- At least $10 in royalties

- At least $600 in rent, prizes and awards, other income payments, etc.

*Vendor - This could be a company name or a person name; companies can be sole proprietor, single member LLCs, multi-member LLCS

*Note - A W-9 should be requested and collected throughout the year, when you first start doing business with the new vendor. All the information you will need to file a 1099, will be on a W-9 form. You may not know if this vendor is a 1099 without the W-9 information. These W-9s must be retained on file.

There are forms out there that you can buy that allow you to type the information in and print out red copy for the IRS and the additional copies needing to be mailed. E-filing is an option, usually an additional charge per vendor*.

To read more on instructions for 1099 forms, click this link here https://www.irs.gov/pub/irs-pdf/i1099mec.pdf