Everything you wanted to know about Landed Costs in QuickBooks Enterprise

Until QuickBooks Enterprise 2020, Landed Cost was just a dream, but now it’s a reality.

With complex inventory, the value of the inventory is much more than just the cost of the raw materials. If you are only tracking the material cost of your product, you could be missing some very key costs and not be charging your customers enough for the goods that you are providing for them. This is very important for your pricing strategy and protecting your bottom line.

Landed Cost is the total or true cost of the product or shipment of products by the time it is delivered to the consumer. The items that make up the true cost are raw materials, shipping and freight charges, and any extra fees for tarping, drayage, lumpers, weight tickets, customs, duties, taxes, tariffs, insurance, currency conversion, packaging, handling, and payment fees. Although this is a full list, there are other items that your company could experience that make up part of the Landed Cost.

- Product : This is the cost of obtaining materials and components from a supplier.

- Shipping: Shipping costs include crating, packing, handling fees, and transportation.

- Customs: Customs clearance expenses occur whenever you’re importing or exporting products between different countries. These include duties, taxes, tariffs, levies, value-added tax (VAT), harbor fees, brokerage fees, and customs broker fees.

- Risk: Any costs to protect your inventory are included in this category, such as insurance, compliance, quality assurance, and safety stock.

- Overhead: These are your ongoing business expenses, including currency exchange rates, payment processing fees, and due diligence.

Previously, a landed cost calculation was not available inside of QuickBooks Enterprise. If you needed the landed cost, then you had to go through a few very painful steps to make your inventory valuation true and complete – a process that was very manual.

In order to set up Landed Cost in QuickBooks Enterprise, you will need to do the following steps:

Turn on Advanced Inventory Preference

This process will create a Landed Cost Account as an Other Asset on the Chart of Accounts.

- From the Edit menu, select Preferences .

- Select Items and Inventory , then select Company Preferences .

- Select Advanced Inventory Settings .

- Select the Landed costs tab, then select Setup landed cost account .

- Create either a new account or use an existing account, then select Save & Continue .

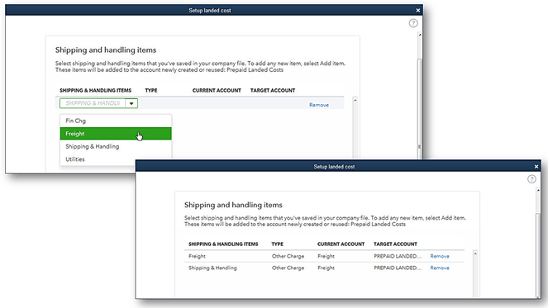

Set up Other Items on the Item List

Add in New Items for tracking Landed Cost and Assign the Expense Account to the new Landed Cost Account. The new Other Charge Items that are set up can then be distributed to the inventory based on quantity, value, weight, or volume.

To do this, follow these steps:

- Select Item List .

- Select Item , then select New .

Now, you’ll need to add it to the landed cost account:

- From the Edit menu, select Preferences .

- Select Items and Inventory , then select Company Preferences .

- Select Advanced Inventory Settings .

- Select the Landed costs tab, then select Manage landed cost account .

- Select Save & Continue .

- Select Add Item , then choose the item to add.

- Select Save & Close .

Using Landed Cost features

Enter in Bill for Inventory as you normally would. Enter in the Extra Cost Items, making sure to use the new Other Charge Items. Note: I like to set up the Landed Cost Item with the name LC – in front of them, so that I can tell the normal freight to hit COGS automatically and the LC – freight, which will be distributed across the inventory value. You will never use the LC – Items in a sales transaction.

Allocate Landed Cost

Choose the bill that you need to allocate the items for landed cost. Below, you will find the items that have not yet been allocated; once they are allocated, they will fall off of the list.

Select the way to allocate the cost: Quantity, Percentage, Amount, or Manually:

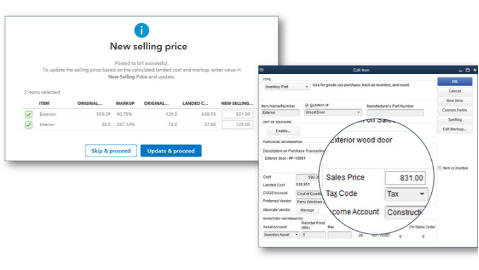

Update Sales Price on Items, based on new Landed Cost:

Reviewing Landed Cost Allocation on bills

Once a bill has an allocated Landed Cost included, then you will see additional columns of the allocated expenses, original cost, and the new landed cost.

Landed Cost is a complex calculation that you would not want to track or allocate manually. QuickBooks Enterprise will now allow you to track and allocate those costs without complex Journal Entries or the need for a way to track what has and has not been allocated.

The post Everything you wanted to know about Landed Costs in QuickBooks Enterprise appeared first on QuickBooks.